PLAYING THE CRYPTO TRADING GAME

PLAYING THE CRYPTO TRADING GAME

Cryptocurrency has been the buzz word for the last few months. We have heard success stories of people becoming millionaires over a span of few months by trading. Cryptocurrency exchanges are now getting flooded with new signups every single day.

This is a simple startup guide with tips for those who have signed up in all these exchanges and are now ready to take the plunge in trading. I am not going to cover the trading basics and terminology as there are a lot of free resources available online. This would be a general, broad introduction to trading crypto.

- Never invest at All-Time Highs (ATH)

Don’t chase the green candles. If the currency is already in parabolic curve and is moving up a lot, then sit that one out. Jumping onto the train at that point of time would be a foolish thing to do. Fear of Missing Out (FOMO) is a natural human instinct. That’s why you should always keep aside your emotions while trading.

When Bitcoin (BTC) was in its last bull run and was going up and up and up during Nov- Dec 2017, there were people who bought BTC at $18k, $19k or even $20k. Look at BTC price today (<$10k). It has been two months and we don’t even know how long it will take for those investors to simply break-even. Therefore if you’re trading, then never invest at all-time highs.

This website gives a clear picture of ATH for all the projects. A 50% or the golden packet fib level retracement would be a good entry point rather than investing at ATH.

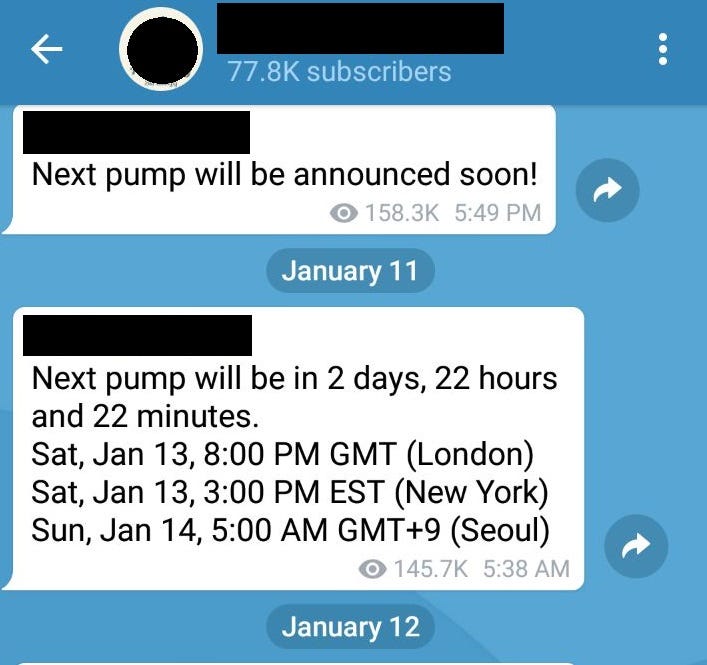

2. Say No to pump and dump groups

Never join pump and dump groups or participate in them for trading- you will be left holding the bag. Ever noticed how all these P&D groups always pump a coin 1 week apart or once in 10 days or something? That’s because, that’s the time the organizers are busy slowly accumulating the coin without causing any suspicion by immediate price spike. They put a sell order on it and then announces the coin to pump and thereby taking massive profits.

3. Tune your Trading Strategy

Try out different methods and see which one suits you- some are good at scalping (taking $30-$50 for small trades and doing multiple trades a day) while others are good at swing trades (holding for a few days and then selling when it hits the target). Do not attempt margin trade with large amounts if you are doing it for the first time.

You should always look at the overall picture based on your strategy. Scalper? Then better pay close attention to 1m, 5m, 15m or even 1 hour charts. Swing trader? 4 hours, 1 day and 1 week are your companions.

Your primary trading exchange should always be the one which has low trading fees, high volume and large spread of good cryptocurrencies.

4. Look for confirmations

Trend reversal confirmations are on the best ways to identify how the market is going to behave. Always look at volume- an upswing without significant volume can be a bull trap.

This was Litecoin (LTC) support channel during Jan 11th 2018. The market was bullish at that time and doing a fib extension would have given a target of $400. But apex is a crucial point. In can either go up or down from there. If someone entered the market at that time before confirmation and went long, we knew what happened next — LTC dropped 50% in value. (Bonus tip: See the volume reduction happening in the above chart)

5. Buy the rumour; sell the news.

Always follow the community and see what’s happening. Checkout daily calendar events and announcements. If there is a rumour of something positive/negative down the road, it will always result in large price actions as the market is volatile now.

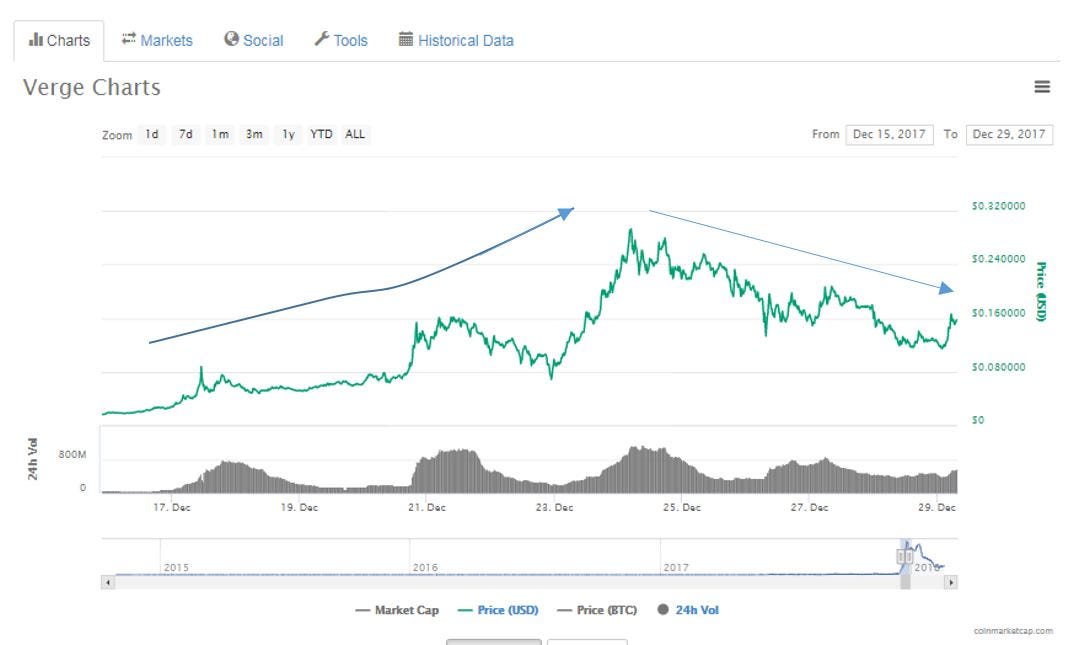

For instance, there was a huge hype about Verge (XVG) releasing its wraith protocol. People were eagerly awaiting it. This anticipation and hype combined with McAfee shill, created a huge demand and the price of XVG doubled. But when the team couldn’t deliver on the promise and the protocol had lots of bugs and issues after release, the price plummeted.

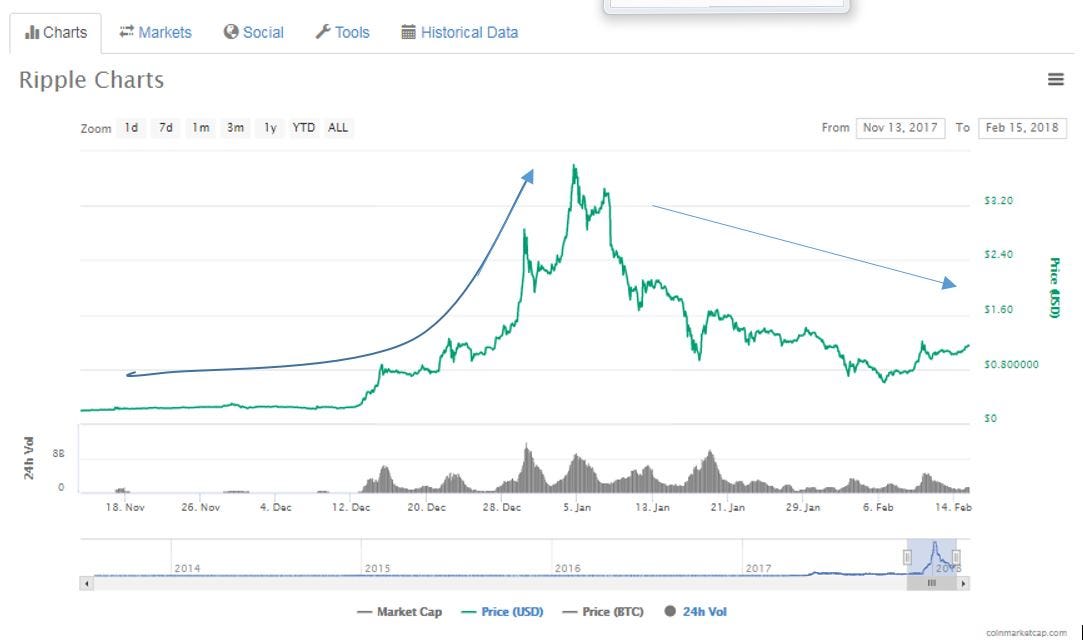

Another example for this is the Ripple-coinbase saga which resulted in massive gains to XRP token price but when the rumors where debunked, the price fell. (P.S: Factors such as Korean regulations and coinmarketcap.com removing Korean premium prices also added fuel to the dipping prices)

6. Always Ladder buy/Ladder sell.

Ladder buying while dipping will ensure that your dollar average cost of buy is lesser if the markets keeps getting pulled down even after your buy order. This would ensure being on profits much easier during the next bull run.

Let’s say you have an initial capital of $3000. You bought your first BTC when it was $18k. Since it was ATH, you were skeptical. So you spent only $1000. Then the markets experienced a pull back and BTC dropped to $12k. You spent another $1000 and bought some more, expecting a bull run. But then, correction continued and it dropped to $8k. You spent your last $1000 on it.

So the average cost of BTC with you is [(1000*18000) + (1000*12000) + (1000*8000)]/3000 = $12,666. This is much easier to break-even and obtain profits rather than you going all in on $19k.

Ladder selling is the exact opposite. Due to some news or hype, a cryptocurrency can go up 30–50% within a few days or even hours (if the volume is low). In these scenarios, always have a goal in mind while trading. Take profits slowly. Set sell limits progressively (say, 10%, 20%, and 30%). This would reduce your total profit but the success rate is higher compared to waiting for the exact tip of ATH and missing it.

7. In trading crypto, chase dollars and not BTC

If you’re in the crypto ecosystem solely for trading and taking profits, then chase dollars. After an alt coin trade, with the profit BTC, lock in the trade and convert to profit. BTC can go up or down 10–15% a day and that would heavily hit your profits depending on whether you are in a bullish or bearish run.

8. “Be greedy when others are afraid and afraid when others are greedy”

Analyse the charts and know the support and resistance levels. If the market is parabolic and moving upwards, it means people are getting greedy and the trend could soon change as everything that goes up must come down. Look for indicators like MACD and RSI overbought regions and if you’re doing margin trading, then you can carefully short your positions resulting in profits when the pullback ensues.

During pull back/correction, keep in mind the key support regions and oversold regions in RSI. This would mean an imminent breakout as we are long term bullish on crypto. If the market is tanking, people would panic sell. Take this opportunity and go for crypto shopping. If you were able to buy BTC at $7k after the recent correction, then you’re already up by 25% in the past week.

9. Psychology of whole numbers

As humans, we like whole round numbers rather than random numbers. So most traders prefer this whole round numbers as well. That’s why you could see large sell walls and resistance at round numbers of BTC like $8k, $9k or $10k. So in order to play this game right, you should set a sell order at $7995 or $8997 or something lower than the ceiling. This would mean that chances of selling are higher as the price may hit your sell order before getting smacked down by the sell wall. Read more about this here.

10. Hone your skills

There are a ton of free resources online for you to become a better trader. Follow crypto news outlet like coindesk for news and cryptosamurai on telegram for updates. Follow subreddits like r/cryptocurrency and r/bitcoinmarkets to get an insight on what is happening with the markets.

On telegram, UK crypto is an excellent channel which sheds light on market movement and technical analysis. Occasionally, they bring to your attention low market cap gem coins which are backed by strong technology.

On twitter, traders like Philakone (scalper) and Eric Choe who are well versed in Elliot waves and Fib extensions/retracements are really helpful and get you to the next level of trading.